The EU Steel Action Plan and the German government's investment package

by Dagmar Dieterle-Witte

A real boost for the steel sector and the non-ferrous metals industry?

The investment package recently adopted by the German government provides for investments of €900 billion over the next ten years. Of this, €500 billion is earmarked for infrastructure, including €100 billion for the Climate and Transformation Fund, and €400 billion for the German Armed Forces. Complementary to Germanies efforts, all EU member states will have to make huge investments in their defense capabilities.

The investment package recently adopted by the German government provides for investments of €900 billion over the next ten years. Of this, €500 billion is earmarked for infrastructure, including €100 billion for the Climate and Transformation Fund, and €400 billion for the German Armed Forces. Complementary to Germanies efforts, all EU member states will have to make huge investments in their defense capabilities.

On European level the EU Steel Action Plan, addresses several key measures to protect the European steel industry. These include an affordable and secure energy supply, the prevention of carbon leakage through the Carbon Border Adjustment Mechanism (CBAM), the protection and expansion of European industrial capacity and the promotion of innovative low-carbon technologies, including the development of green lead markets.

But to what extent do these measures have the potential to significantly influence the demand for steel and non-ferrous metals such as copper and aluminum?

Let's take a look at the impact of the measures on the steel sector, Europe’s largest metals industry in terms of sales:

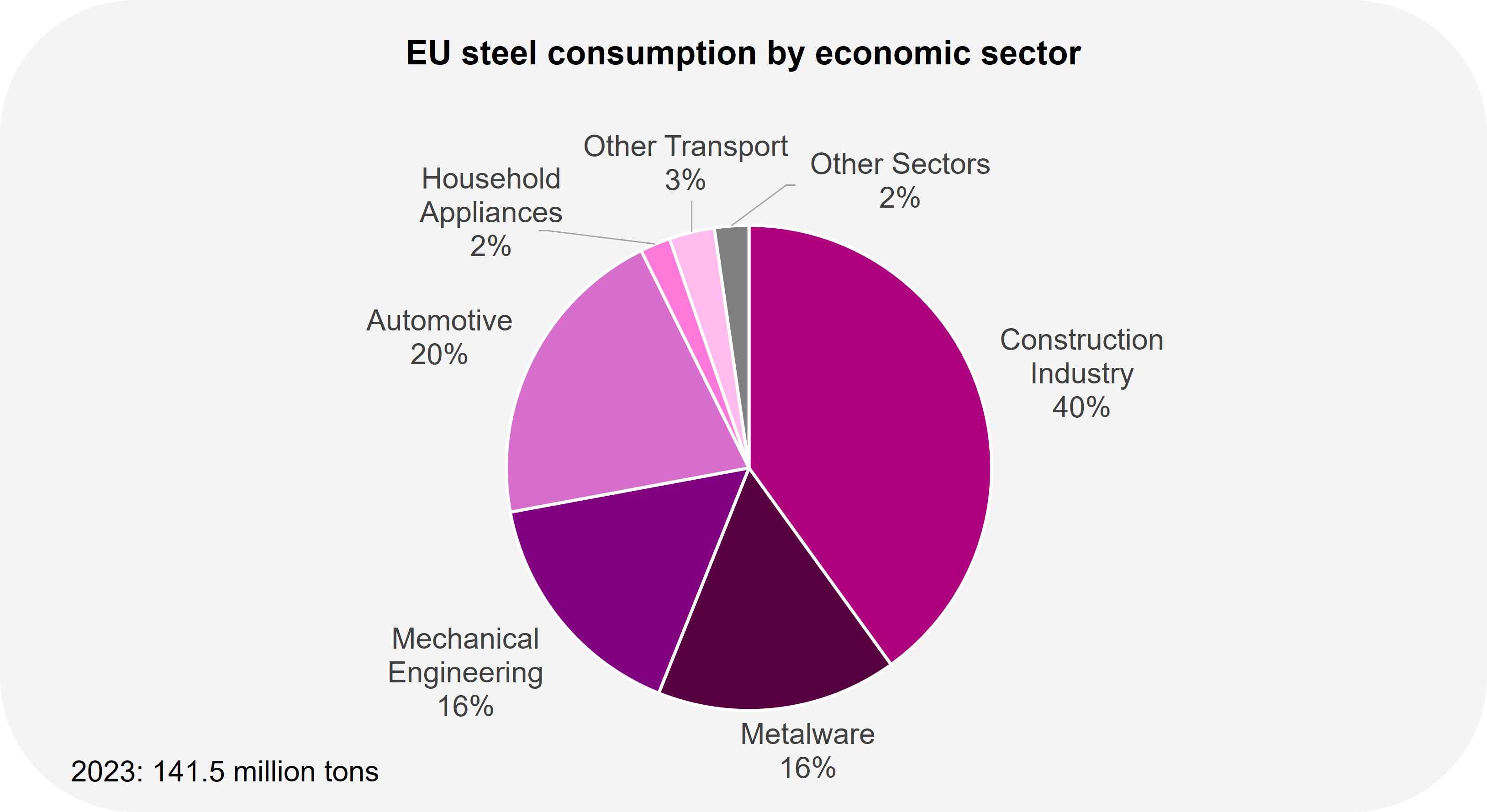

We begin our investigation with the defense industry, for which precise figures on sales and steel consumption are not available for security policy reasons. Consumption is recorded in the metal products category (see figure). Although the defense industry is steel-intensive, its share of total EU steel consumption is small. Here is a simple calculation example to illustrate this: EU member states have a total of 1,600 battle tanks. If each tank contains about 50 tons of steel and the number of battle tanks is to be doubled, this corresponds to an additional steel requirement of about 80,000 tons. By comparison, 12.1 million cars were produced in the EU in 2023. Assuming 0.8 tons of steel per car, this corresponds to a steel consumption of about 10 million tons (approx. 120 times as much). The direct influence of the defense industry on the demand for steel is therefore manageable, but there will also be indirect influences. For example, new machinery (e.g. CNC milling machines for small arms) will be needed to produce new weapons and transportation equipment (ships, planes, trucks) will be needed to transport the weapons systems, however also this will have only a minor impact on total sales of the European steel industry.

The construction industry, which accounts for about 40% of steel consumption in the EU, is significantly more important in terms of volume than the defense sector. Let's do another simple calculation example here to put the relevance of the German government's investment package into perspective: In 2023, the construction industry in Germany generated a turnover of about €430 billion and required about 14 million tons of steel. With the planned additional investment in infrastructure of €500 billion by 2035, this results in an annual increase in turnover for the industry in Germany of around 12% (€50 billion per year). Assuming that the demand for steel grows in proportion to turnover, steel consumption in Germany for the construction sector would also increase by 12%, or about 1.7 million tons. However, with steel consumption in the EU at 141.5 million tons, this represents growth of only about 1.5%.

The construction industry, which accounts for about 40% of steel consumption in the EU, is significantly more important in terms of volume than the defense sector. Let's do another simple calculation example here to put the relevance of the German government's investment package into perspective: In 2023, the construction industry in Germany generated a turnover of about €430 billion and required about 14 million tons of steel. With the planned additional investment in infrastructure of €500 billion by 2035, this results in an annual increase in turnover for the industry in Germany of around 12% (€50 billion per year). Assuming that the demand for steel grows in proportion to turnover, steel consumption in Germany for the construction sector would also increase by 12%, or about 1.7 million tons. However, with steel consumption in the EU at 141.5 million tons, this represents growth of only about 1.5%.

Due to the importance of the automotive industry for the EU in general and as a significant market for the steel industry in particular, accounting for around 20% of steel consumption, we must also look at this sector. The automotive sector is still finding its way in the field of e-mobility and is also struggling with tariffs and international competition. The steel action plan and the investment package do not have a direct impact here and are not driving the urgently needed upturn. However, the German government is also planning investments in this segment (including the promotion of electric cars and the development of charging infrastructure), and another EU action plan is intended to help stabilize the European automotive industry. It remains to be seen whether this will only stabilize the current level or return to the sales volumes recorded in 2018/2019.

Conclusions for the steel industry:

Conclusions for the steel industry:

The measures initiated by policymakers are providing an important boost to the European steel industry – mainly via investments in the construction industry - but will not be sufficient to bring the industry back to its former level. On the one hand, demand is expected to shift away from the automotive industry to the construction industry, which has different requirements (quality, logistics, etc.). On the other hand, the falling demand in the automotive sector will hardly be offset by the rising demand in other sectors.

What is important now, is that the political activities are implemented as quickly as possible while the steel companies need to face future challenges and urgently implement the associated necessary changes.

What this means for individual steel companies in concrete terms cannot be answered generally. Effective actions to restore business success will depend on the respective business model and therefore on various factors, including

- the vertical integration of production (crude steel production and/or further processing),

- the supply chain (machinery & logistics),

- the market positioning,

- the product portfolio,

- the customer base.

Impact of the measures for the non-ferrous metals industry:

The non-ferrous metals industry, such as copper and aluminum, has also struggled with a decline in demand in recent years, but is likely to benefit from the measures taken by the German government and the EU in a similar way to the steel industry. Here too, the construction industry is an important source of volume and is directly affected by the measures. The industry will also benefit from rising demand in mechanical and electrical engineering, which is indirectly driven by the investment measures. The fact that the industry plays an important role in the production of electric cars also has a positive effect, which means that the negative trend in the automotive industry should not be as severe for the nonferrous metals sector. However, the challenges in the non-ferrous metals industry are generally the same as those in the steel industry, as declining demand and a changing demand structure are forcing companies in the sector to take action.