Bronk & Company: European steel demand to stagnate through 2030

by David Fleschen

According to an updated steel demand forecast by German metal management consultancy Bronk & Company, the European steel industry is facing a prolonged period of stagnation, with no structural growth expected through 2030 despite a modest recovery from the current downturn.

The analysis, which updates the firm’s previous Steel Demand Forecast 2030, places the current market situation in the context of geopolitical tensions, weak European economic growth, ongoing trade conflicts and the additional financial burden created by the transition toward climate neutrality. While parts of the global economy are showing signs of recovery, Bronk & Company notes that Europe continues to lag behind.

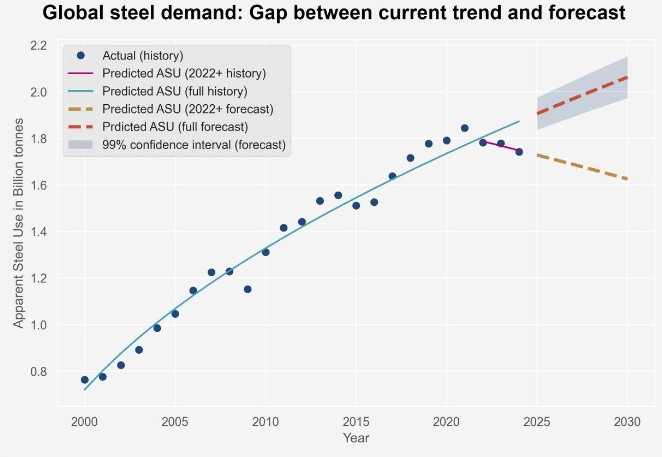

Globally, steel demand is projected to reach around 2.06 billion tonnes by 2030, within a forecast range of 1.97 to 2.15 billion tonnes. This would represent an increase of roughly 18 percent compared with 2024, but only about 12 percent above the historic peak reached in 2021. However, the consultants stress that global growth momentum has slowed significantly since 2021. Weak demand in China, the war in Ukraine, trade disputes and structural shifts in global supply chains have pushed actual consumption below its long-term trajectory.

China remains the decisive factor. With current steel consumption of around 900 million tonnes, roughly 100 million tonnes below the 2021 level, the country is no longer acting as a short-term growth engine. Bronk & Company concludes that other regions, including India and emerging economies, are unable to compensate for this decline in the near term. As a result, global steel demand offers limited growth opportunities for European producers.

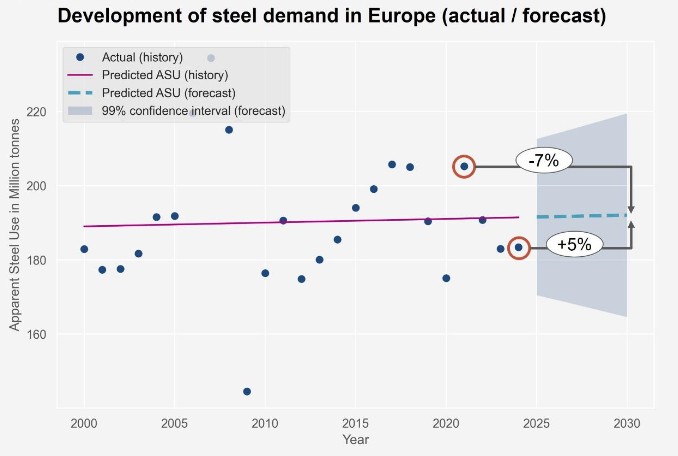

For Europe, the outlook is particularly sobering. Bronk & Company now assesses European demand as a single market including the EU27, the UK, Norway, Switzerland and Turkey, excluding Russia and Ukraine due to sanctions and the ongoing war. Steel demand in Europe is expected to reach around 192 million tonnes by 2030, about 7 percent below the peak year of 2021, but roughly 5 percent above the very weak level of 2024. The forecast range remains wide, between 170 and 220 million tonnes, reflecting the historically high volatility of European steel demand.

The consultants underline that this translates into two strategic realities for the European steel industry: no structural demand growth is expected over the rest of the decade, and fluctuations of around plus or minus 10 percent must be anticipated.

A closer look at steel-consuming sectors confirms this cautious outlook. Automotive production in Europe is shrinking and reducing capacity, offering no short-term growth potential for steel demand. This is partly offset by expected growth in construction, mechanical engineering and metalware, driven by infrastructure programmes, housing investment and the expansion of renewable energy. Even so, Bronk & Company does not expect European demand to return to the strong levels seen in 2017, 2018 or 2021 in the next one to two years.

North America shows a similar picture. Steel demand is forecast to reach around 131 million tonnes by 2030, down about 3 percent compared with 2024 and 8 percent below the 2021 peak. While US government investment programmes and industrial policy are currently supporting demand, Bronk & Company sees this as politically driven and temporary rather than a structural shift. In addition, US tariff policy continues to limit market access for European suppliers.

In its conclusion, Bronk & Company describes the outlook for European steelmakers as persistently challenging. With weak global demand, stagnant core markets and rising competitive pressure, the firm argues that efficiency, cost leadership and operational flexibility will be decisive factors. According to the consultants, maintaining competitiveness will require far-reaching changes across sales, procurement, production, HR and controlling, as European steel producers adapt to a market environment defined less by growth and more by resilience.

Source and Graphics: Bronk & Company, Photo: Fotolia