Eurofer urges EU-U.S. steel trade deal to safeguard exports and stop deflection

by David Fleschen

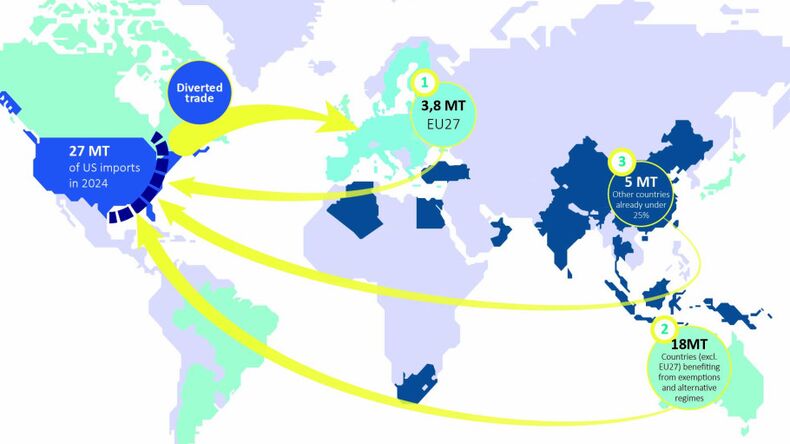

The European Steel Association (EUROFER) has voiced strong concern over the delay in reaching a new trade agreement on steel between the European Union and the United States. The association warns that the current 50% U.S. tariff on steel imports puts approximately 3.8 million tonnes of EU exports at risk and increases the likelihood of trade deflection from the U.S. into the EU market.

EUROFER argues that the prolonged uncertainty is worsening conditions for the European steel sector, already under strain from global overcapacity and rising production challenges.

“We cannot continue with U.S. steel tariffs at 50%. As we lose our major export market, the European market is being flooded by the steel the U.S. is no longer absorbing. We are particularly disappointed by the absence of a joint EU-U.S. approach preserving EU steel exports to the U.S. and tackling trade diversion towards the EU on top of massive global overcapacity — now 5 times larger than the EU’s total steel production. This glut is destroying entire value chains, undermining industrial resilience, defence capabilities and the green transition,” said Dr Henrik Adam, President of the European Steel Association (EUROFER).

EUROFER also criticized the slow implementation of the EU’s Steel and Metals Action Plan, warning that initial measures have yet to yield tangible improvements for the industry.

“What is even more concerning is that while the U.S. — regardless of the administration — has consistently pursued a bold industrial strategy, the EU has fallen behind. The implementation of the Steel and Metals Action Plan has yet to deliver tangible results. Any potential benefits from the last EU steel safeguard review have been entirely wiped out due to its low level of ambition and the disastrous impact of the U.S. tariffs, which is only beginning to materialise,” added Dr Adam.

According to EUROFER, recent U.S. policy has supported the domestic steel industry through a combination of low energy costs, green subsidies, a Buy U.S. steel policy, and import restrictions. The increase in blanket tariffs is expected to reinforce these trends, helping to secure volumes for newly installed capacity and boosting domestic production. In contrast, the EU steel sector reportedly lost 10 million tonnes of capacity in 2024 — the highest annual closure rate recorded.

Before the tariff hike, the EU was the third-largest steel exporter to the U.S., following Canada and Brazil, with exports of approximately 4 million tonnes.

EUROFER further criticises EU-level responses to energy price challenges. The association says the Affordable Energy Action Plan and the Clean Industry State Aid Framework have failed to significantly improve conditions for energy-intensive industries. It also points to the EU’s electricity market design as a fundamental issue that remains unresolved.

Key legislative proposals under the Steel and Metals Action Plan are scheduled for release in the second half of 2025. These include a new trade defence instrument in September to replace existing steel safeguards, and by December, an updated proposal to strengthen the Carbon Border Adjustment Mechanism (CBAM), including action on resource shuffling and export leakage.

“The game changer for a business case in Europe is not there yet. If these key measures on trade and CBAM are addressed by the European Commission as half-heartedly as energy prices, we will inevitably continue to see more capacity closures, job losses, and stalled decarbonisation projects. If that happens, there will only be losers: EU steel producers wiped out by cheap, carbon-intensive imports, and an EU transition and climate ambition that falter without solid industrial foundations,” concluded Dr Adam.

Source and Graphic: Eurofer