Eurofer: EU Climate Target sparks concern over industrial readiness

by David Fleschen

The European Commission’s proposal to cut greenhouse gas emissions by 90% by 2040 has drawn a cautious response from the European Steel Association (EUROFER), which warns that the current industrial and policy landscape falls short of supporting such an ambitious goal.

While welcoming the overarching objective of climate neutrality by 2050, EUROFER argues that achieving the intermediate 2040 target would require an unprecedented transformation of EU industry — a shift it describes as tantamount to a new industrial revolution. According to the association, the enabling framework to support this shift remains incomplete.

“Europe’s steel sector is committed to decarbonisation and has put forward more than 60 large-scale projects aimed at significantly reducing emissions by 2030,” said Axel Eggert, Director General of EUROFER. “However, the absence of timely and effective policy support has already caused delays and even cancellations. A 90% reduction by 2040 risks becoming unrealistic unless decisive action is taken now.”

The steel industry in the EU has experienced a significant contraction, with production falling by 26 million tonnes over the past six years. Investment levels have also stagnated. EUROFER calls for full and rapid implementation of the EU’s Steel and Metals Action Plan, with particular emphasis on strong trade defence measures against global overcapacity, improved access to competitively priced low-carbon energy and raw materials, and a robust Carbon Border Adjustment Mechanism (CBAM).

The group also raised concerns about recent EU measures aimed at supporting industrial transformation, including the Clean Industrial Deal State Aid Framework (CISAF). While recent communications acknowledge existing challenges, EUROFER argues that the impact of these initiatives remains limited. The association cites overly restrictive conditions within CISAF, such as strict rules on funding duration and accumulation, as barriers to long-term investments in electro-intensive industries like steel.

EUROFER also questioned the design of the proposed CBAM export mechanism, noting the absence of a legal proposal and expressing uncertainty over whether the suggested use of CBAM revenues would be as effective as free allocation for export purposes. The EU steel sector exports over €25 billion in steel products annually, alongside an estimated €40 billion in CBAM-covered downstream goods.

“There is much debate about target levels and flexibility, but not enough focus on the reality of the EU’s industrial base,” Eggert said. “Climate goals must be pursued through innovation and investment within Europe, not by allowing deindustrialisation to take root.”

To support the transition, EUROFER is calling for a coordinated EU approach that includes:

-

Access to competitive low-carbon energy

-

Measures to counter global steel overcapacity

-

A CBAM system that prevents circumvention

-

Retention of ferrous scrap within the EU

-

Incentives for European content in manufacturing

The association reiterated its readiness to work with EU policymakers to ensure that industry has the tools it needs to support Europe’s climate ambition while remaining competitive on the global stage.

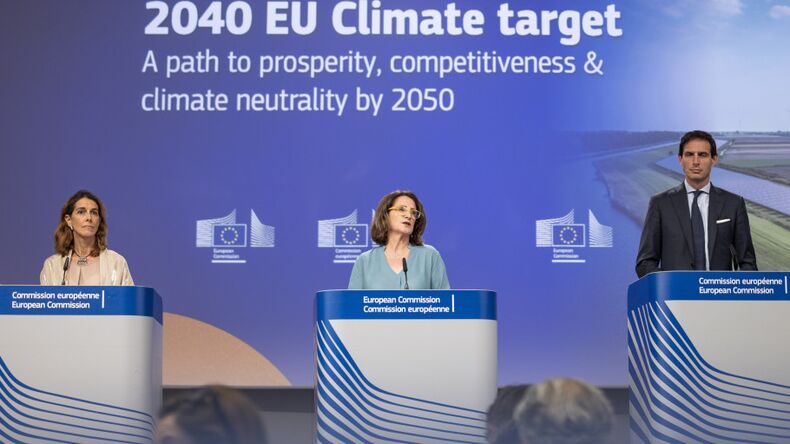

Source and Photo: Eurofer