Worldsteel: Indirect steel trade climbs 26% over the past decade

by David Fleschen

The World Steel Association (worldsteel) has released its latest study on global indirect trade in steel, covering the period from 2014 to 2024. The data underline the growing importance of steel embedded in manufactured goods within international trade flows.

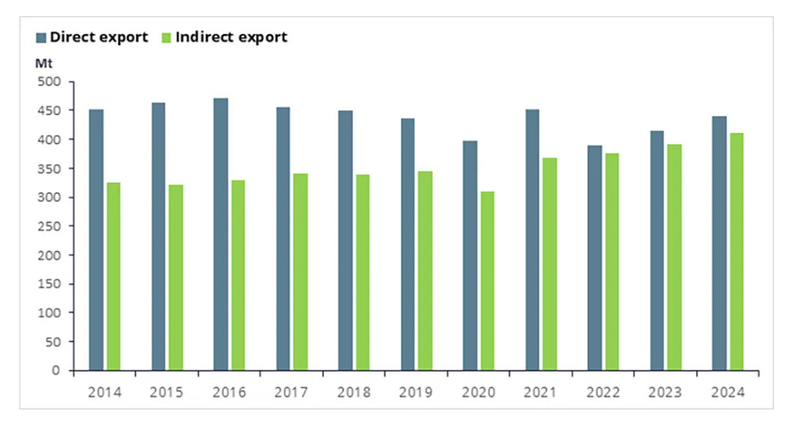

According to the report, indirect exports of steel from the 74 countries analyzed rose from 325 million tonnes in 2014 to 410 million tonnes in 2024 – an increase of 26% over the decade. In volume terms, indirect trade in steel last year was equivalent to 93% of global direct steel exports, highlighting how closely trade in finished goods now mirrors shipments of primary steel products.

Worldsteel defines indirect trade in steel as the movement of steel contained within traded manufactured goods such as vehicles, machinery, appliances, and metal products. To calculate these volumes, the association applies so-called “steel coefficients” to thousands of traded product categories. These coefficients estimate how many tonnes of finished steel are required to produce one tonne of a given manufactured item.

The organization bases its calculations on the Harmonised Commodity Description and Coding System (HS) of the United Nations. Approximately 1,000 six-digit HS codes were used to capture steel-intensive goods in detail. Trade data were sourced from the UN Comtrade database, which provides global statistics on cross-border shipments in both value and volume terms.

For analytical purposes, worldsteel groups indirect trade results into six major sectors: metal products, mechanical machinery, electrical equipment, domestic appliances, automotive, and other transport equipment. These categories correspond to the steel-using sectors applied in worldsteel’s broader steel-weighted industrial production (SWIP) analysis.

The new figures illustrate the structural shift in global steel demand, with an increasing share of steel crossing borders in processed form rather than as raw or semi-finished material. For producers and traders, the trend underscores the importance of downstream markets and manufacturing competitiveness when assessing future steel consumption patterns.

Source and Graphic: Worldsteel