Worldsteel publishes data on indirect trade in steel from 2013 to 2023

by David Fleschen

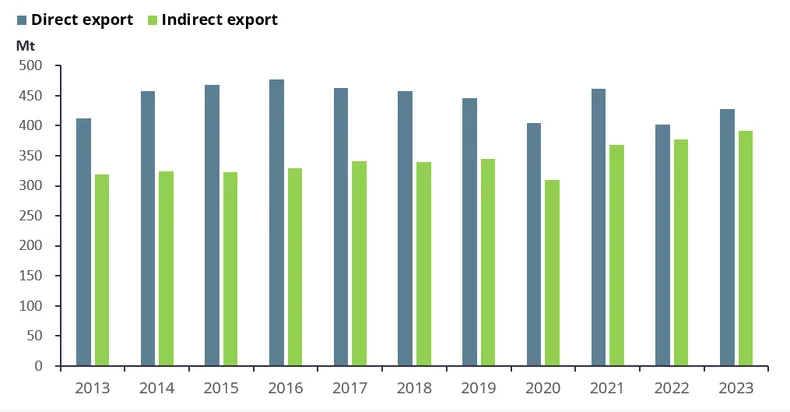

Worldsteel has released updated data on indirect trade in steel, covering the period from 2013 to 2023. According to the figures, indirect exports of steel from the 74 countries analysed increased by 23 percent, rising from 319 million tonnes in 2013 to 392 million tonnes in 2023. The volume of indirectly traded steel last year was equivalent to 95 percent of global direct steel exports, highlighting the growing significance of steel embedded in finished goods.

Indirect trade in steel refers to the movement of steel through the export and import of manufactured products that contain steel components. To calculate these figures, Worldsteel uses a methodology based on steel coefficients—industry estimates of how much finished steel is required to produce one tonne of a given product. These coefficients allow for the conversion of product-level trade volumes into finished steel equivalents.

The study draws on trade data from the United Nations Commodity Trade Statistics Database (UN Comtrade) and applies classifications based on the Harmonised Commodity Description and Coding System (HS) at the six-digit level. Approximately 1,000 product codes were included in the analysis, allowing for detailed coverage across a broad range of sectors.

For reporting purposes, Worldsteel grouped the results into six major steel-using industries: metal products, mechanical machinery, electrical equipment, domestic appliances, automotive, and other transport equipment. These groupings align with the association’s established categories used for analysing steel-weighted industrial production.

The findings underscore the continued shift from raw material trade toward value-added exports, particularly in industrialised and manufacturing-oriented economies. As global supply chains become more integrated, indirect steel trade has emerged as a critical component for assessing true international demand, steel intensity in production, and downstream sector competitiveness.

Source and Graphic: Worldsteel